Using Multi Leg Trades In Unusual Options Flow

How to Leverage Unusual Options Flow and Multi-Leg Trades to Spot Profitable Trade Ideas

Options trading offers a world of opportunities, but deciphering the market's intricate signals can be challenging. One powerful strategy involves analyzing unusual options flow combined with multi-leg trades. This approach can help traders uncover actionable trade ideas by identifying where the “big money” is positioning itself.

Multi-leg trades involve executing two or more options positions simultaneously. Examples include spreads, straddles, and iron condors. Finding these trades in unusual options flow can provide even deeper insights into market sentiment and expectations:

- Bullish or Bearish Bias: A large bullish call spread indicates confidence in upward movement, while a bearish put spread signals downside expectations.

- Volatility Projections: Trades like straddles and strangles reflect expectations of significant price swings, regardless of direction.

- Hedging Activity: Protective puts or collars can signal risk aversion in the underlying asset.

Finding Multi Leg Trades On Bullflow

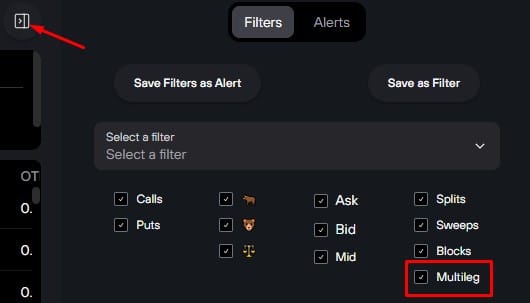

By default, you will NOT see multi leg trades. These trades need a little more deciphering and understanding than single lines of flow, so by default we don't show them. To activate them, go to your side bar panel. Click the box that says "Multi Leg" and return to the main flow screen.

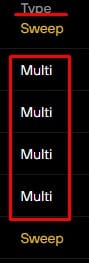

To see which trades are designated as multi leg, look in the "TYPE" column for the label.

Analyzing Multi Leg Trades

When you spot a multi-leg trade, decipher its structure to understand the trader’s intent:

- Vertical Spread: Indicates a directional idea with defined risk/reward.

- Straddle/Strangle: Suggests anticipation of volatility but uncertainty about direction.

- Butterfly/Condor: Reflects expectations of limited price movement within a range.

Correlate Flow with the Broader Market and News

Unusual options activity becomes more meaningful when paired with fundamental and technical analysis:

- News: Check if unusual flow coincides with insider buying, M&A rumors, or macroeconomic events.

- Technical Levels: Confirm if the flow aligns with key support/resistance zones or breakout patterns.

- Sector Trends: Align trades with broader industry momentum for higher conviction.

Examples of Trade Ideas

- Unusual Call Buying + Bullish Vertical Spread:

- An institution buys out of the money calls while simultaneously selling a higher strike call. This suggests confidence in moderate upside movement with capped risk.

- Your Trade Idea: Enter a similar call spread or purchase the same call strike outright.

- High Put Volume + Protective Put Spread:

- Significant put buying combined with the sale of lower-strike puts could indicate hedging ahead of potential downside.

- Your Trade Idea: Short the underlying stock or buy protective puts.

- Straddle with Heavy Volume:

- A large straddle trade on a stock ahead of earnings suggests expectations of significant volatility.

- Your Trade Idea: Execute a straddle or trade the underlying stock post-earnings breakout.

Unusual options flow and multi-leg trades provide a wealth of information for savvy traders. By understanding these signals and combining them with sound analysis, you can spot high-probability trade ideas and stay ahead of the market. Remember, while these tools can enhance your trading edge, no strategy is foolproof—always manage risk and adapt to changing conditions.