Unusual Options Activity: How to follow quality flow

In our last article, we took a look at what unusual options activity is and why we follow it. Today’s let’s learn about what specific flow we like to see. Remember, ALL FLOW IS NOT CREATED EQUAL!

When people first start using an options scanner, many of them think they are going to be rich in a month. It’s easy right? I’m just going to pay for a scanner and follow the trades that it finds, and in no time I’ll be making thousands of dollars a day. The problem with that thinking is that you have to learn the craft, like any other. I always ask people, if you’ve never golfed before, do you think it would be realistic to grab a golf club for the first time and be on the PGA tour in 6 months? No? Well, the same goes for trading. Trading is a brutal profession where you’re competing against killers whose success is hinged upon taking your money. So, you better be realistic about the learning curve and what it takes to be successful in this industry.

An options scanner is definitely a great tool to have in your arsenal and know how to use properly. But, like any other tool, you have to know how to use it. An options scanner is going to show you what is going on in the options marketplace. Most of them have varying degrees of filters so you can narrow down the type of information you’re looking for. Even with filters, there can be a large amount of information to sort through. That’s because we don’t know what is unusual, unless we can see everything that is going on. What might be unusual for one ticker might not be for another. The filters you use to narrow down your data may be relevant for one ticker but not for another. So, how do we REALLY find what stand out?

There is a pattern to the high probability options flow

When I first became an unusual activity options flow trader, I spent two years digging into the data to try to find a pattern for what ended up being quality trades. The data went through two major revisions to really key in on what trades generated nice profits vs which ones didn’t stand a chance. Now, there is no way to really know if a trade is going to profit or not, not even for the hedge funds. After all, if we could see the future, this profession would be a lot easier! But what I did find was that the unusual options flow that turned out to be highly profitable did fit into a very specific pattern.

There is a general description of what I’m looking for on the options scanner. But, that description needs further explaining, as the details hold the secret to success. To start with, that general description of what I’m looking for is “aggressive buying by the hedge funds.” Let’s take a look at what that means.

Size, Time, Urgency

What does aggressive buying look like? During my classes, I always taught people to look for size, time, and urgency. This is your starting point. By size, we mean a lot of capital committed. The bigger the dollar amount committed, the more you know that is a hedge fund trading. The reason we want to follow the hedge funds instead of some random trader is because we generally rely on their research departments and inside information. They don’t commit millions of dollars to a trade to lose it. While they do lose on some of their trades, the majority of trades that fit this pattern profit. So, we want to see a large amount of capital committed to the trade. (More on this later, as the definition of large will also vary).

For time (although this definition varies also), the more the better. Hedge funds don’t commit millions of dollars to a trade only to turn around and flip out of it in four hours. We have seen that from time to time, but it would be rare. No one is going to commit a large amount of capital to a trade that expires in six months and turn around to close that position in a few days. The costs of buying that much extra time on an options contract wouldn’t be worth it if they knew they were going to close the trade in the short term. So, by buying lots of time, they are allowing for some ups and downs in the underlying while not having to close out for a short term loss. They commit capital and sit on the position to let it work out beyond a day trader’s time frame.

Urgency means, how quickly do they want to get into a position? If there is a rush to get into the position with no regards for what they are paying for the contracts, that’s a good sign. Options scanners will show how the trades were placed. To see urgency in the trades, we want to see sweeps and splits that fill on the ask or even above the ask. This would be the equivalent to a market order, where the important factor is getting into the trade and getting filled immediately rather than worrying about what specific price the trade will fill at. Think about it like this. If someone is willing to pay above the current ask to get into a position, that means they want in, and they want in NOW! The price doesn’t matter, just fill the position!

Specifics

What we’re really looking for is an aggressive entry from the big money traders. So here’s how the descriptions above vary based on the general idea. Aggression can look differently for different trades. For example, if someone is buying a weekly contract and putting $300,000 into it, that may be just as aggressive as someone putting $1 million into something expiring in a year. While the dollar amount may be lower, the time for those contracts to pay out is much shorter. So that smaller dollar amount can be looked at as more aggressive because that underlying has to move in the right direction, it has to move fast, and it can’t retrace.

The other thing to look at is the normalcy of the ticker. What do I mean by that? Well, If I see two trades, one on TSLA and one on HD, both for $1 million dollars, both for the same expiration, the HD trade will be much more aggressive. Even though they have the same dollar amounts and same expirations, the HD trade is more aggressive because TSLA will regularly see $1 million trades on it, while HD does not. So, $1 million in TSLA isn’t too aggressive to me and doesn’t immediately stand out, as it is normal for that ticker. But the same amount going into a name that doesn’t normally see that kind of dollars would stand out.

So, lots of people ask what dollar amounts are we looking for to follow options flow. As shown above, there just isn’t an answer to that. I might follow $300,000 in a trade but ignore a $1 million trade. It’s not the dollar amount that stands out, per se, it is the aggression. So, always be sure to evaluate options flow on a case by case basis, with the general theme of, “aggressive buying from the big money traders.”

This can seem confusing at first, and it is! I’ve had many people go through the options flow class then send me some flow thinking it met all of the criteria. Then when I point out a reason why I didn’t like it, they respond with, “oh yeah, I forgot about that part!” The way to get comfortable with this is like anything else. Seat time. Nothing can replace experience. The more you study the options flow scanner, the more you will start to see what is normal for each individual ticker. Then, once you understand what is normal for a ticker, you will start to easily spot what is unusual.

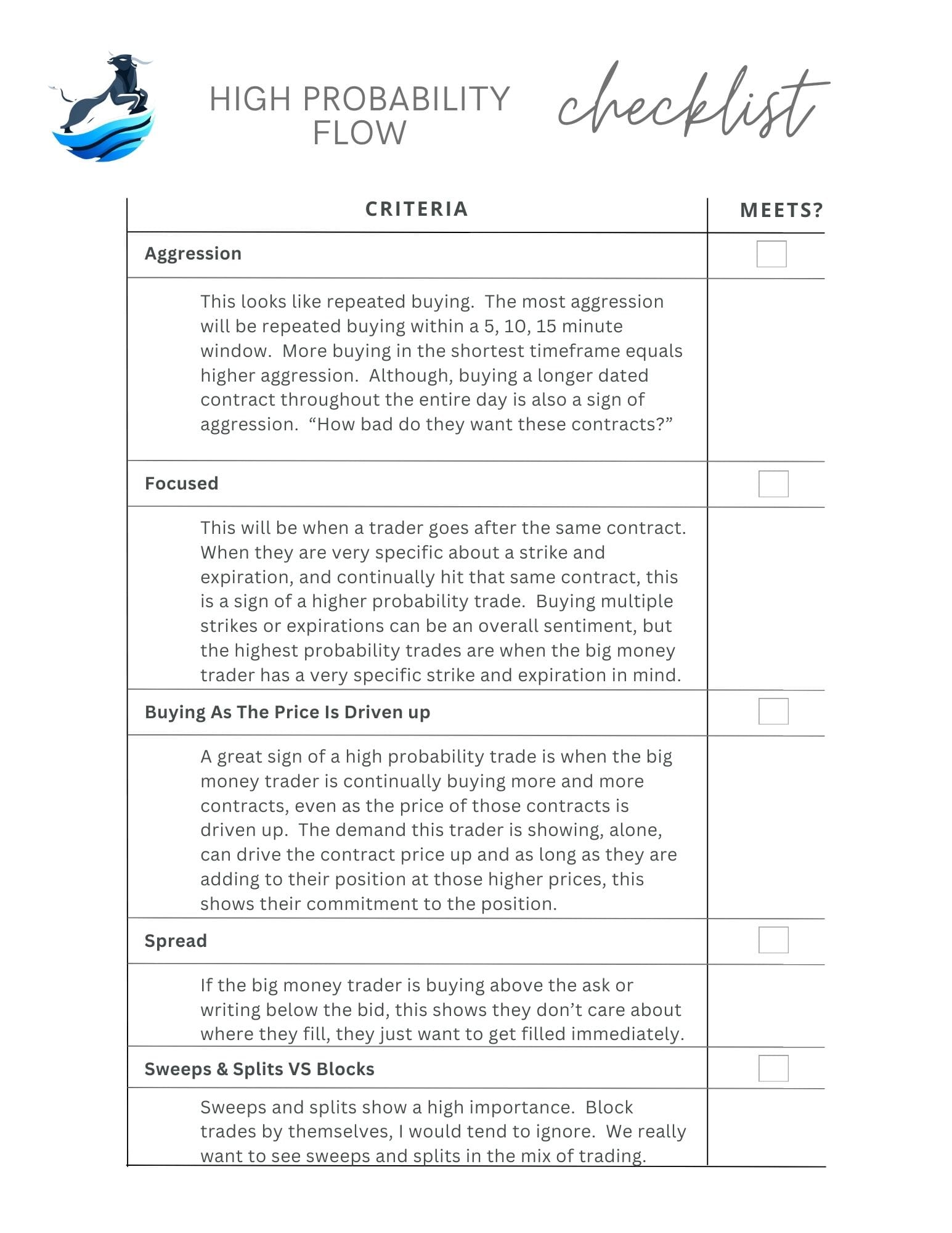

I have a check list that spells out each of the criteria I’m looking for in a trade. After trading for a while, you won’t need the check list. I can spot flow in a split second that I might want to follow, no check list needed. The check list becomes automatic with experience. But, to start, it might be helpful to follow the check list before entering a trade, to verify that what you’re following meets the criteria for high probability flow.

Final note

I have seen options flow that meets everything I’m looking for and fail. I have also seen options flow that doesn’t meet anything I’m looking for and succeed wildly. As traders, what we do is trade on probabilities. By following the checklist, you have a much greater chance of that trade producing profits. Once you get comfortable with the check list as a starting point, you can adjust it to meet your specific trade style and criteria.