Find Profitable Trades Using the Bullflow Options Scanner

Can you really profit from Unusual Options Flow? The answer is a resounding yes—but only if you know what to look for. In this post, we’ll break down the five key indicators that often signal a higher probability for profits. Plus, we’ll show you an easier way to track these signals in real-time, so you’re not left scrambling when opportunity knocks.

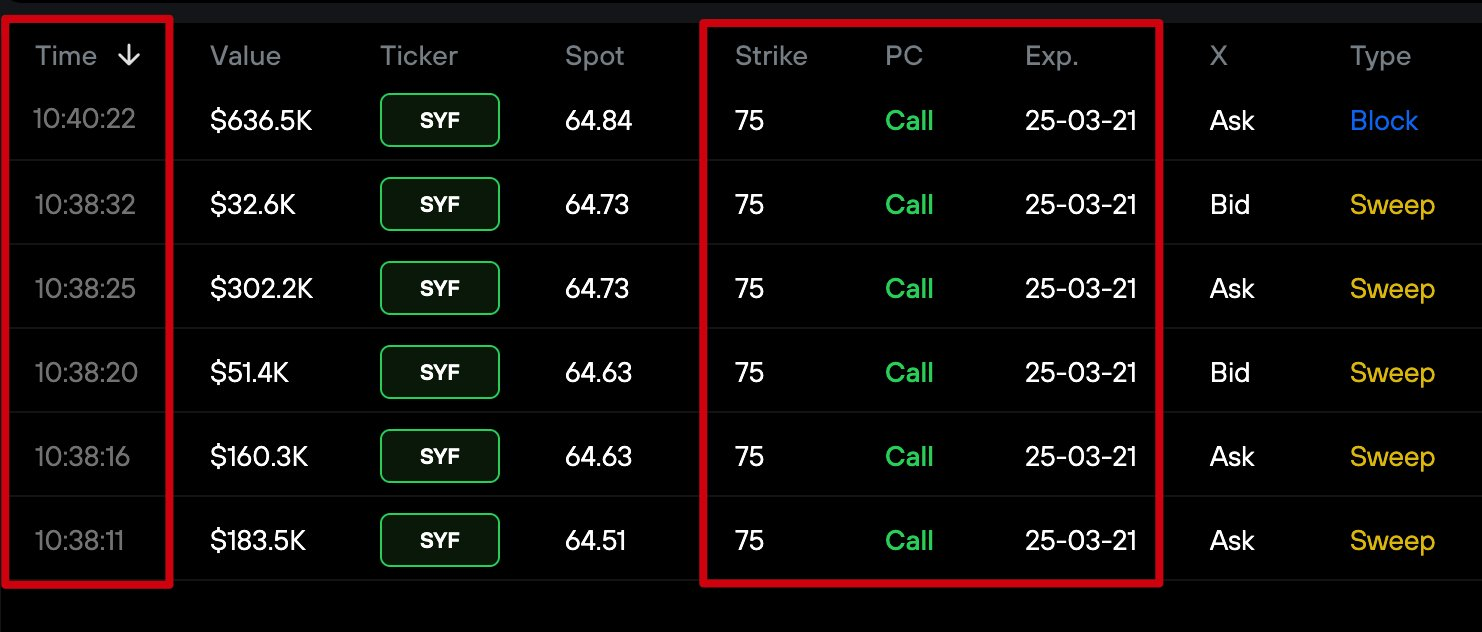

1. Aggressive Buying of the Same Contract

The first sign you’re dealing with a potentially lucrative trade is aggressive buying. This happens when a buyer snaps up the same option contract multiple times in a short window—say 5, 10, or 15 minutes.

Why It Matters:

When someone keeps buying the same contract over and over, it’s a strong hint that they have conviction about the trade. They’re not just trying to grab a quick scalp; they’re building (or adding to) a position fast because they believe the underlying stock could make a big move.

What to Look For in Your Flow Scanner:

- Multiple consecutive trades for the exact same contract within minutes. This is very important!

- A noticeable uptick in volume during those trades.

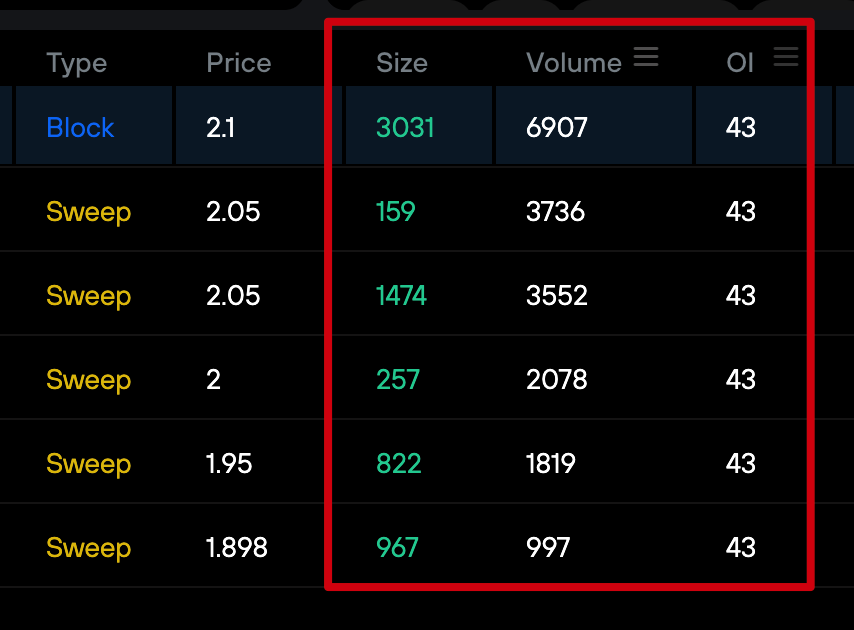

2. Unusual Volume

Your second major clue is unusual volume.

Why It Matters:

When volume surpasses the open interest (OI), it signals new trades coming in fast. Even more telling is if individual trades themselves exceed the current open interest. This implies that entirely new positions are being opened, rather than an old position being closed or rolled over.

What to Look For in Your Flow Scanner:

- Volume column changing to purple to indicate volume > OI.

- Large individual trades showing green in the size column indicates a single trade has exceeded OI.

In simpler terms, big players are piling in. The more contracts they buy, the more you can infer they might be expecting a significant move in the near future.

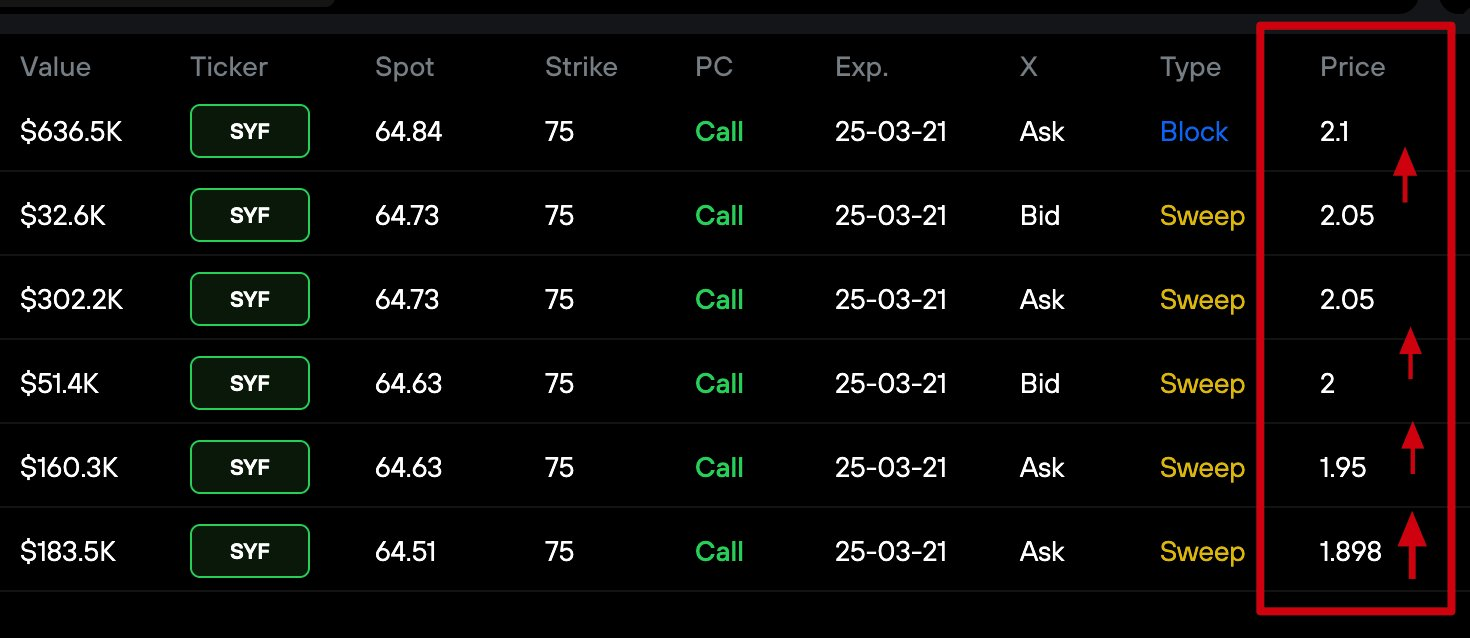

3. Buying as Contract Price Goes Up

A third indicator is buying even as the price climbs. Rather than waiting for dips, the trader relentlessly keeps adding to their position—paying more with each purchase.

Why It Matters:

Options traders who aren’t sure about a move might get worried if the contract’s price spikes. They usually wait for pullbacks to jump in. But if the buying continues even though the contract price is getting more expensive, that’s a strong show of confidence.

What to Look For in the Bullflow scanner:

- Consecutive trades at incrementally higher prices (Price column).

- A “buy at any cost” mentality where the premium isn’t a deterrent.

4. Most Trades Hitting the Ask Side

If you’re seeing orders consistently hit the ask side, it means the trader is willing to pay up—no haggling involved.

Why It Matters:

Most traders try to get in at a middle or lower price to save on premiums. If someone’s slapping the ask repeatedly, they care more about getting the contracts quickly than saving a few bucks. That urgency often indicates strong conviction or insider knowledge—either way, it’s a clue worth following.

What to Look For in Your Flow Scanner:

- Numerous trades executed at or near the ask price (X column).

- Consistent buying at premium prices rather than bargain hunting on the bid.

5. Sweeps

Finally, we have sweeps—one of the best indicators of urgent buying. Sweeps execute a large order across multiple exchanges as fast as possible.

Why It Matters:

Sweep orders help a trader fill a big position without tipping their hand to the market (or at least, not as obviously). When you see multiple sweep trades for the same contract, it’s often a red flag that “big money” is in a rush. And if they’re in a rush, they’re probably expecting a swift, significant price movement.

What to Look For in Your Flow Scanner:

- Multiple trades labeled “Sweep” in quick succession.

- Short time intervals between each sweep.

Putting It All Together

Each of these five indicators—aggressive buying, unusual volume, buying as the price rises, ask-side buys, and sweeps—serves as a puzzle piece. One indicator alone might pique your interest, but when all five pop up in the flow, that’s where the real magic happens. Chances increase that you’ve stumbled on a high-probability setup.

Pro tip: Use the "Bullflow" quick filter in your flow dashboard to find these trades even easier!

Of course, no strategy is foolproof. Always pair your flow analysis with a little due diligence on the underlying stock—are there upcoming earnings, news events, or technical trends that support the move? The more pieces of confirmation you have, the better your odds.

Ready to Try Flow Trading?

Looking for a way to spot these indicators in real-time without emptying your wallet? BullFlow.io has you covered. Our powerful flow scanner makes it easy to identify these five signals (and more!), and our educational Discord community is always on hand to help you interpret the data.

Want to see it for yourself? Start a free trial and get full access to real-time unusual options flow, along with a supportive community that can guide you every step of the way.

Happy trading!